If you are looking for courses to elevate your corporate finance skills this year in 2025, here is my recommended list of the top 5 courses.

In this article I have discussed the course highlights, ratings, and pricing of each so that you can have a complete picture.

Let’s get started.

Table of Contents

ToggleProfessional Finance Courses for Career Growth

If you’re serious about advancing your corporate finance career, you can look into these 5 corporate finance courses to elevate your corporate finance skills.

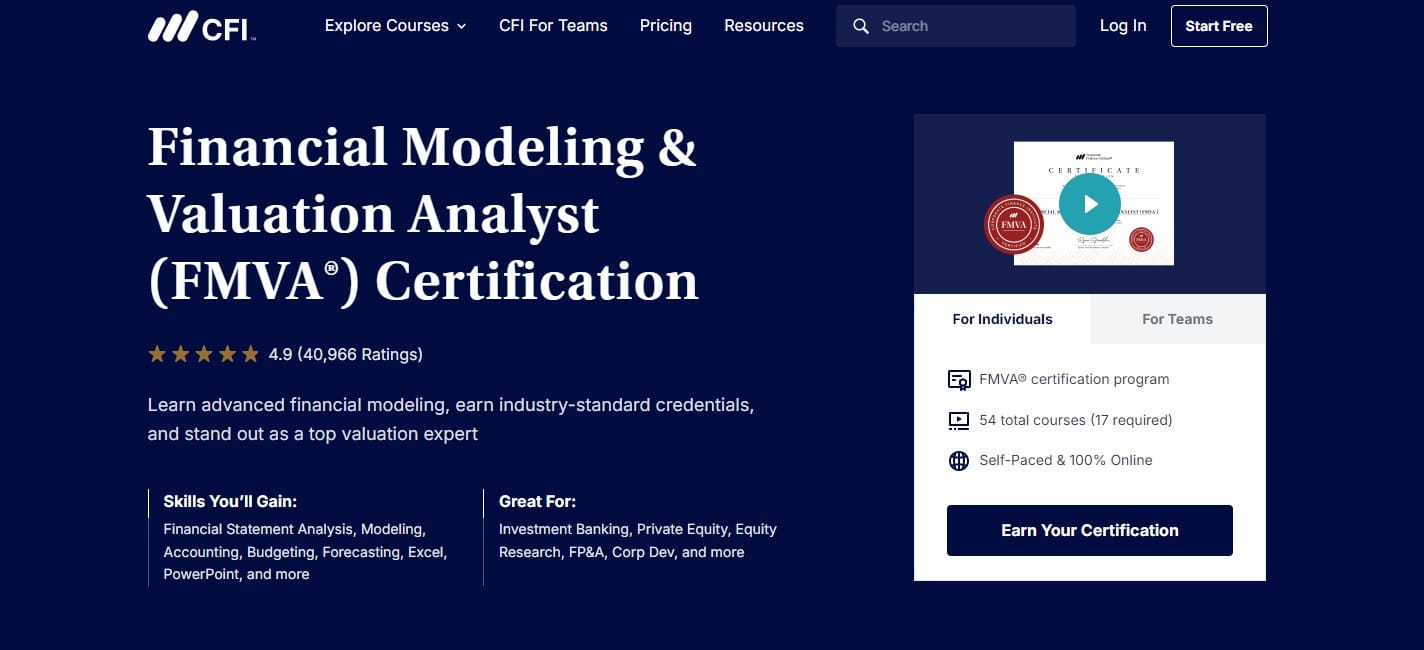

1. Corporate Finance Institute (CFI) – Financial Modeling and Valuation Analyst (FMVA®)

CFI FMVA program is one of the most popular corporate finance courses for finance professionals. This program covers essential topics such as financial modeling, financial statement analysis, and advanced valuation techniques. You can also enroll in to the corporate finance institute free courses and also get certified.

Course Ratings: ⭐⭐⭐⭐⭐4.9/5

Course Details

- Duration: 4-6 months

- Course Highlights:

- 54+ courses with 100+ hours of video content

- 200+ interactive exercises

- Case studies and Excel-based financial modeling training

- Blockchain certificate upon completion

- Best For:

- Investment Banking

- Private Equity

- Equity Research

- FP&A

- Corporate Development

- Pricing:

- Full Immersion Plan: $508.20 (40% OFF)

- Self-Study Plan: $298.20 (40% OFF)

- Additional discounts available using CFI coupons

Why Choose This Course?

- Recognized industry-wide certification

- In-depth coverage of financial modeling

- Hands-on case studies and Excel-based applications

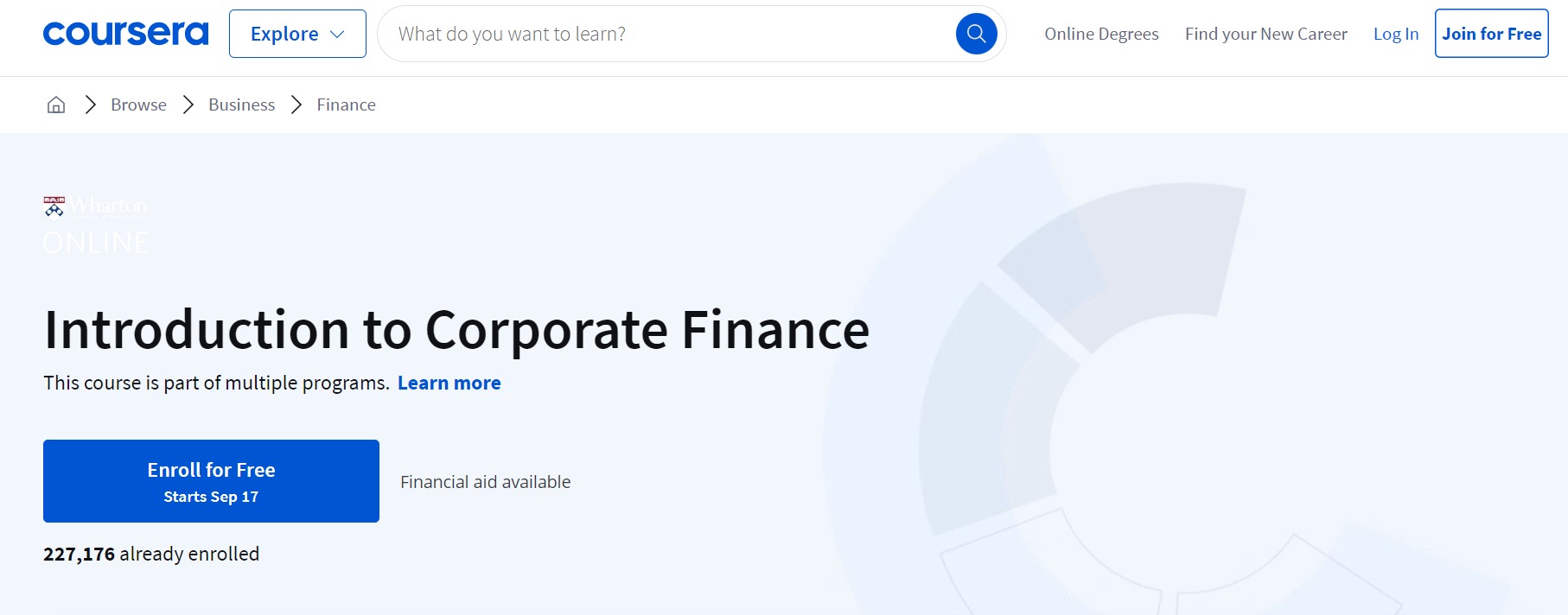

2. Coursera – Introduction to Corporate Finance (University of Pennsylvania)

Coursera offered by the University of Pennsylvania, this course introduces fundamentals of corporate finance, including capital budgeting, discounted cash flow (DCF), and risk management.

Course Ratings: ⭐⭐⭐⭐⭐4.6/5

Course Details

- Duration: Self-paced online course (7 hours to complete)

- Course Highlights:

- In-depth lectures on time value of money, risk, and return

- Exercises to apply theoretical knowledge to real-world scenarios

- Flexible learning at your own pace

- Includes 4 assessments

- Best For:

- Beginners starting their financial journey

- Financial Analysts

- Pricing: Enroll for Free

Why Choose This Course?

- World-class instruction from the University of Pennsylvania professors.

- Best for beginners

- Covers essential concepts in Corporate Finance

- Earn a certificate

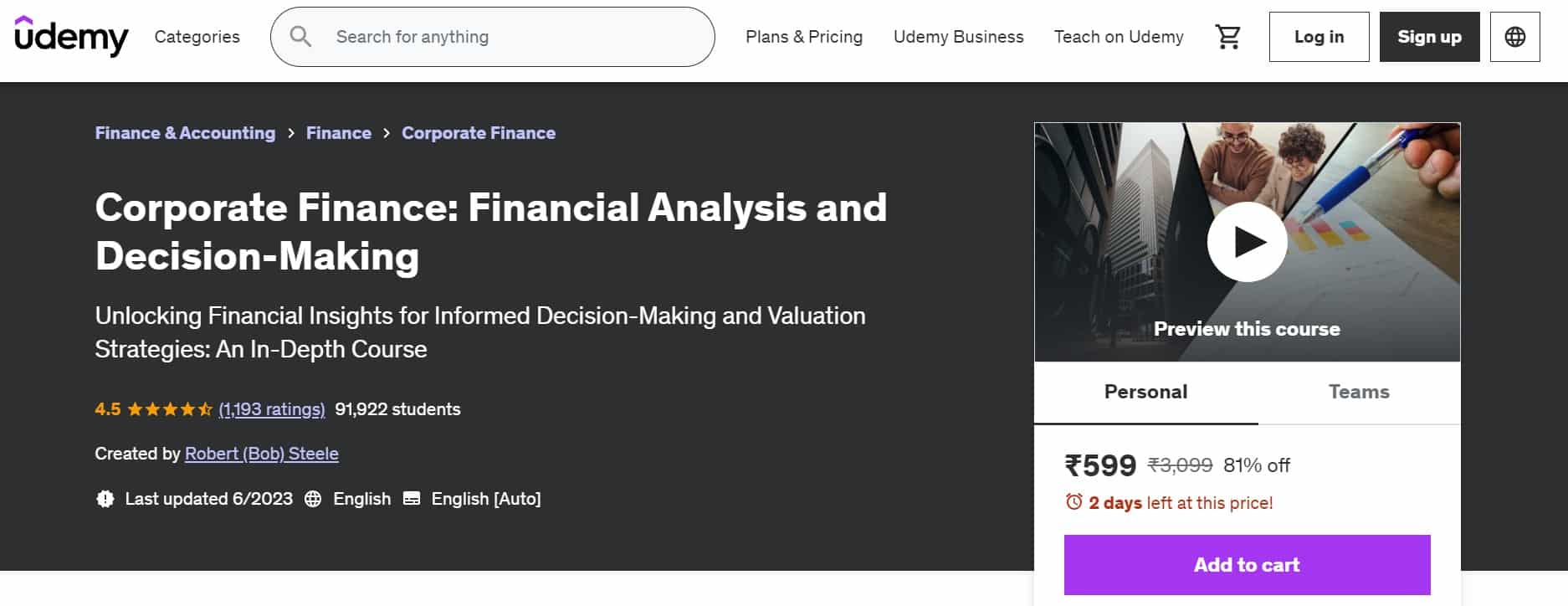

3. Udemy – Corporate Finance: Financial Analysis and Decision Making

This corporate finance training program on Udemy focuses on teaching corporate finance fundamentals, including decision-making and risk assessment.

Course Rating: ⭐⭐⭐⭐⭐4.5/5

Course Details

- Duration: Self-paced (approximately 163.5 hours of video content)

- Course Highlights:

- Learn financial planning, capital raising, and investment decisions

- Real-world corporate finance examples, including startups

- Understand cost of debt, cost of equity, and WACC calculations

- Apply NPV, IRR, and payback period for investment decisions

- Learn risk management using standard deviation, beta, and diversification

- Best For:

- Accounting professionals

- Business owners and managers

- Finance professionals and analysts

- Pricing: $89.99 for lifetime access

Why Choose This Course?

- Affordable pricing and lifetime access

- 19+ Practical lessons

- Learn the basics of budgeting, financial forecasting, and cash flow management

- 383 downloadable materials

- Certificate of completion

4. edX – Professional Certificate Corporate Finance (Columbia University)

edX Columbia University’s Introduction to Corporate Finance program is another introductory program that covers various aspects of corporate finance, including capital markets, governance, and long-term financial decisions.

Course Ratings: ⭐⭐⭐⭐4/5

Course Details

- Duration: 3-4 months

- Course Highlights:

- Understand theoretical and practical finance principles

- Analyze free cash flow

- Learn valuation and discounting methods

- Value stocks and bonds

- Compute returns on projects and investment decisions

- Estimate returns on assets

- Best For:

- Investment Banking

- Private Equity

- Financial Consulting

- General Management

- CFO Track Jobs

- Pricing: $607.50

Why Choose This Course?

- Certificate from an Ivy League university

- Comprehensive knowledge of corporate finance concepts

- Taught by distinguished Columbia professors

- Get an accredited professional certificate

5. Harvard Business School Online – Leading with Finance

Harvard’s Leading with Finance course teaches you how to use corporate finance principles to make better business decisions, focusing on real-world applications and leadership.

Course Ratings: ⭐⭐⭐⭐4/5

Course Details

- Duration: 6 weeks (six modules)

- Course Highlights:

- Learn how financial strategies impact business operations

- Study case studies from global corporations

- Understand key financial features of a market

- Learn to measure value and profits

- Gain insights into capital markets

- Best For:

- Individuals at all levels of finance

- Beginners or professionals aspiring for leadership roles

- Pricing: $1850

Why Choose This Course?

- Prestigious certification from Harvard

- Focus on leadership in financial decision-making

- Self-paced course with regular deadlines for assignments

Career Opportunities After Completing These Courses

Now, the main question arises: Why should you take a Corporate finance course? Is it worth it? Can you get a job after completing a course?

Once you complete a corporate finance training program, you will possess a skill set that sets you apart from your competition. While it does not mean you are being handed a job directly, you will unlock many career paths. Here are some of the roles you could pursue:

- Financial Analyst

As a Financial Analyst, you analyze financial data to assist companies in making the right investment decisions. Your knowledge of Excel skills, financial modeling, and data analysis will come in handy here.

- Investment Banker

As an investment banker, you can assist corporations with mergers, acquisitions, and capital raising. Valuation techniques, financial modeling, and deal structuring are key skills that recruiters look for, and these courses will also teach you these skills.

- Corporate Treasurer

As a Corporate Treasurer, you will manage a company’s liquidity, investments, and risk. For this role, you need knowledge of cash flow management, risk mitigation, and investment strategies. A corporate finance training program will be perfect for learning these skills.

- Risk Manager

As a Risk Manager, you will assess and manage financial risks for organizations, ensuring your company’s success. Risk analysis, financial planning, and regulatory compliance are top skills that companies look for in managers, and with a certificate in this course, you will definitely land a job.

- Chief Financial Officer (CFO)

If you are aiming for leadership roles, these corporate finance courses will be very helpful for you. With proper strategy and decision-making, Leadership skills, strategic financial planning, and capital management, you can lead a corporation’s financial operations.

Corporate Finance Courses – Quick Overview

Before I get into the course details, here is what corporate finance means. Corporate finance is a branch of finance that teaches you to handle a corporation’s financial activities, including sourcing capital, managing resources, and making decisions that maximize shareholder value.

It involves studying financial strategies, investment decisions, funding options, and financial risk management.

Here are the key aspects of Corporate Finance:

- Capital Budgeting

- Capital Structure

- Working Capital Management

- Financial Risk Management

- Dividends and Return of Capital

With a corporate finance course, you will have the skill and expertise to maximize a shareholder’s value, balance financial risk with business probability and prediction, and effectively allocate resources for maximum returns.

In simplest terms, you will become an essential asset for any company that is looking to grow.

For beginners, here are some examples of Corporate Finance in action:

- A company decides whether to build a new factory or expand an existing one.

- They raise funds by issuing bonds or equity to fund a major acquisition.

- Managing cash flow to ensure day-to-day operations can continue without interruption.

There are many corporate finance training programs for the course, but selecting the right one can be challenging, especially if you are a beginner this is where this article will be quick helpful.

Conclusion: Which Course Is To Choose

Overall, taking up a corporate finance course will only enhance your knowledge and experience, whether you are a beginner who just wants to know the subject or a professional looking for a senior leadership role.

I have included the top 5 corporate finance courses in this article that will suit’s you all.

So, sign up for the one that best suits your needs and get started.

FAQs

What are the best corporate finance courses online for beginners?

For beginners, Coursera Introduction to Best Corporate Finance courses by the University of Pennsylvania is a good place to start. It provides a comprehensive introduction to the topic with essential exercises and a certificate.

Is CFI FMVA certification worth it?

Yes, CFI’s FMVA certification is widely recognized and is known to have a high rating among students with high-quality course content and an accredited certificate upon completion.

Where can I get a corporate finance course certificate?

To earn a certificate in corporate finance, you can enroll in CF FMVA course or Harvard Business School’s Leading with Finance program and sign up now.